Turbulence and Secrecy Shake US Defense in 2025

The year 2025 marked a turbulent chapter for the U.S. defense industrial base as a series of procurement challenges, congressional interventions, and escalating secrecy in major Pentagon programs reshaped the defense landscape. According to a detailed retrospective titled “Industry Chaos, Congressional Clampdowns, And Secret CCA Contracts: 2025 Review” published by Breaking Defense, the defense sector navigated a storm of delays, internal restructuring, and growing tensions between innovation imperatives and oversight responsibilities.

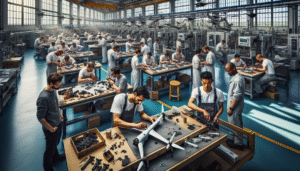

At the center of the year’s disruption was the Department of the Air Force’s Collaborative Combat Aircraft (CCA) program, a highly classified initiative aimed at delivering autonomous drone wingmen for manned fighter jets. Though the program is viewed as a cornerstone of future air dominance, much of its key progress remained behind closed doors. Industry observers criticized the Air Force’s decision to delay crucial contract announcements for CCA increment one, keeping both the winners and their proposals concealed far longer than anticipated. This unprecedented level of secrecy raised questions about transparency and long-term sustainability, as well as potential vulnerabilities in the program’s industrial capacity.

The CCA program was not alone in facing scrutiny. Across the defense sector, industry players—from established primes to agile startups—grappled with intense uncertainty. Budget ambiguities and shifting strategic priorities forced many firms to reevaluate their investment strategies. Several key programs, like the Next Generation Air Dominance (NGAD) and the Replicator initiative aimed at fielding thousands of attritable drones, encountered slow ramps or ambiguous guidance, further complicating business planning.

Congress, meanwhile, became increasingly vocal in demanding program accountability and greater oversight. In response to widespread concerns about the Defense Department’s acquisition pace and fiscal discipline, lawmakers imposed stricter reviews on major technology initiatives. These clampdowns were most evident in the 2025 defense authorization and appropriations processes, which featured new reporting requirements, funding withholds, and conditional approvals tied to program performance.

Industry executives interviewed across the year voiced growing frustration with what many saw as an unpredictable acquisition environment. Several firms exited high-profile competitions or downscaled involvement in risk-heavy ventures, citing opaque requirements and a lack of clear program pathways. The result was a fractured market in which some companies thrived under bespoke contracts and classified initiatives, while others struggled with diminishing visibility into future opportunities.

Despite the turbulence, the year also brought glimpses of opportunity and transformation. A number of defense technology firms leveraged small business innovation research funding and streamlined prototyping channels to pursue breakthrough capabilities, from AI-enabled autonomy to multi-domain networked command systems. While these efforts lacked the scale and prestige of marquee programs, they suggested a potential path forward: a defense ecosystem that balances secrecy with agility, and oversight with innovation.

As 2025 drew to a close, it became increasingly clear that the Pentagon’s acquisition system is at a generational crossroads. Whether it can reconcile the competing demands of speed, secrecy, and accountability in 2026 remains an open question—but one that will shape the contours of American defense strategy for years to come.