Middle East Defense Transforms Amid Missiles and Space

As 2025 drew to a close, the Middle East’s defense sector revealed a year of sweeping transformations—marked by aggressive missile development, record-breaking defense contracts, and ambitious strides into space. According to a comprehensive year-end analysis published by Breaking Defense titled “Middle East Missiles, Large Contracts, and Space Ambitions: 2025 Review,” the region’s defense landscape is undergoing a profound shift, driven by security concerns, technological investments, and growing geopolitical influence.

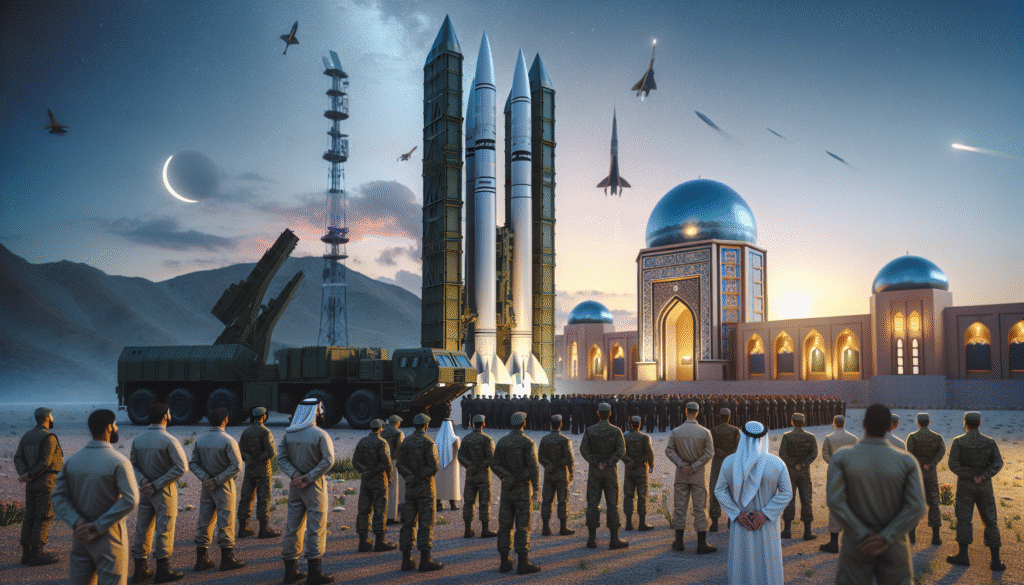

At the heart of the region’s evolution is a fast-paced missile proliferation. Iran and Israel continued to lead the way, refining precision-strike capabilities and pushing the envelope on range and payload capacities. Iran unveiled a series of new missiles during state-run military parades, while Israel advanced its Arrow-4 system in collaboration with the United States. In the Gulf, nations such as the United Arab Emirates and Saudi Arabia deepened their missile defense portfolios, acquiring advanced interception systems and integrating them into broader regional security architectures.

The urgency behind missile advancements has been shaped in part by growing regional tensions and the need for strategic deterrence. Attacks on energy infrastructure and maritime targets have underscored vulnerabilities across key economic assets, prompting governments to prioritize defensive and offensive missile technologies alike.

The financial scope of these efforts has also surged. Defense spending in the Gulf Cooperation Council (GCC) countries climbed sharply in 2025, with multiple countries securing multibillion-dollar contracts for aircraft, cybersecurity systems, and unmanned platforms. Saudi Arabia, in particular, fast-tracked its Vision 2030 goals by solidifying partnerships with Western defense firms and pursuing domestic manufacturing capabilities. The year also saw Qatar and the UAE finalize agreements for next-generation combat aircraft and integrated command-and-control systems.

Breaking Defense reports that these transactions are not only quantitative milestones, but also indicators of deeper defense-industrial alignment. Many regional governments are coupling procurement with domestic production agreements, knowledge transfer initiatives, and research partnerships to foster local defense ecosystems. This represents a strategic pivot away from simple buyer status toward becoming co-developers in emerging defense technologies.

Another striking development in 2025 was the region’s advancement into space. Long the domain of superpowers, space has become a strategic frontier for Middle Eastern states. The UAE, building on the legacy of its Mars mission and astronaut program, launched a satellite focused on military reconnaissance, while Saudi Arabia announced plans to co-invest in launch infrastructure and small satellite technologies. Israel expanded the scope of its space security coverage, investing in antisatellite defense and orbital surveillance systems.

The year also saw a recalibration of diplomatic dynamics related to defense and space pursuits. Several countries pursued joint defense projects and technology-sharing agreements, strengthening ties that augment both national capabilities and collective deterrence postures. These alignments point to an emerging recognition that regional threats—ranging from drone incursions to cyber warfare—require multinational responses.

In summation, the developments chronicled in Breaking Defense’s “Middle East Missiles, Large Contracts, and Space Ambitions: 2025 Review” underline a pivotal year for the region’s defense and strategic posture. As missile capabilities mature, defense budgets swell, and space becomes increasingly contested, Middle Eastern countries appear committed to asserting greater autonomy and influence in the global security arena. The trajectory reveals a region not only confronting immediate threats but actively shaping its long-term strategic environment.